The per diem deduction alone can save pilots and flight attendants thousands of dollars each year if they itemize. EZPerDiem calculates it painlessly in minutes.

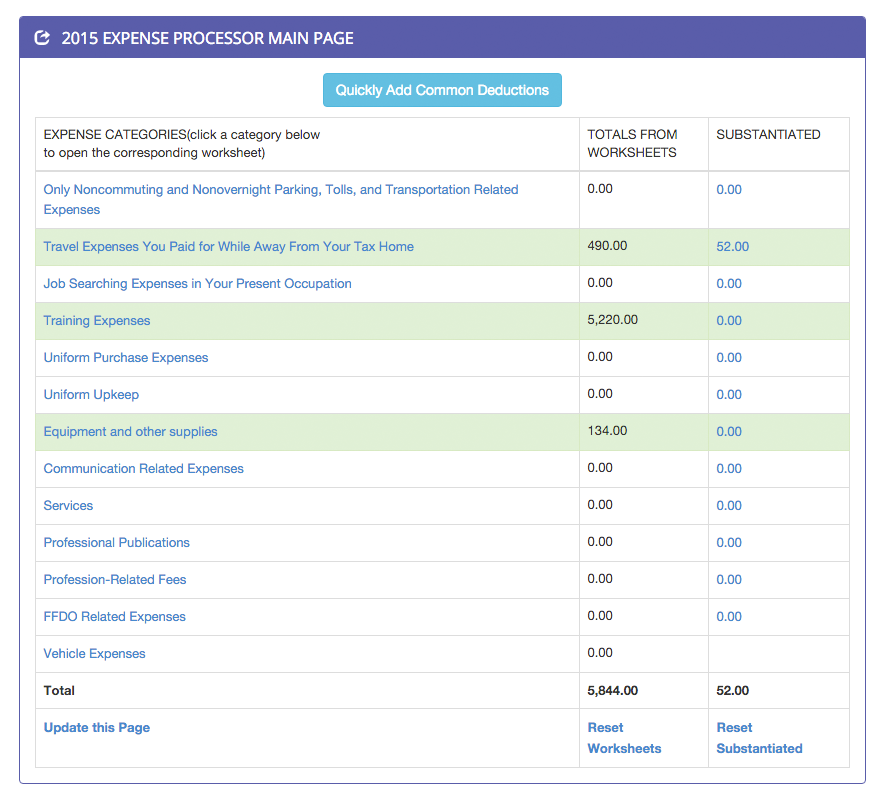

Pilots and flight attendants can deduct other expenses associated with their job. EZPerDiem allows you to quickly find and organize these tax deductions.

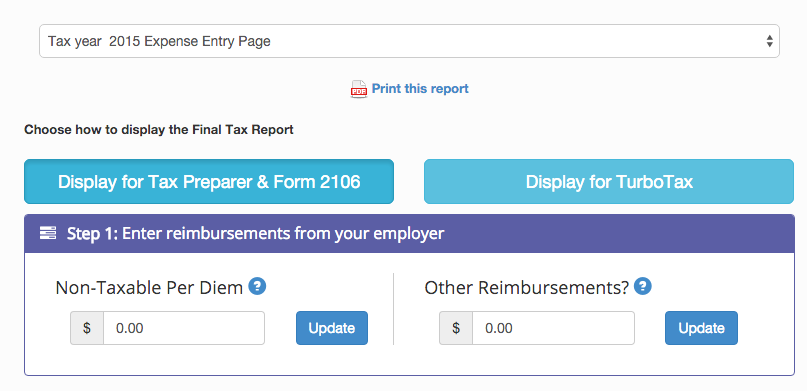

Once finished, if you choose to pay for the Final Tax Report, you can then easily enter the expenses on EZPerDiem into TurboTax or print and email the report to your accountant.

EZPerDiem is completely free to try, and if you purchase the report and don't benefit, we simply refund you. We take all of the risk away so you feel comfortable giving this a try.

No Risk. When you join, you will be sent an email to validate, and you will be able to test EZPerdiem completely for free. If you don't like what you see, simply don't pay.

2007 © EZPerDiem.com. All Rights Reserved. Privacy Policy | Terms of Service